- Market Analysis — Investing — Trading Methods At The Morgan Report For Only $50 Per Month. | http://www.themorganreport.com/join.

- Starting your own precious metals savings program is an easy way to automatically save in gold and silver. This makes it easy to maintain a disciplined program for increasing your ownership of history’s most proven stores of value. Learn more here.

Why the Silver Bull Run is Inevitable | https://www.themorganreport.com

In the late 1990s, on the cusp of the turn of the millennium, legendary investor Warren Buffet made a big move: he purchased roughly 130 million troy ounces of silver — primarily bought off the COMEX at a price around $5 an ounce. Now, it is public knowledge that Buffet is a value investor, targeting assets that he believes are trading for less than their intrinsic value. It may have been for this reason that, after his 1997 move into silver, investors shifted their attention to the undervalued metal.

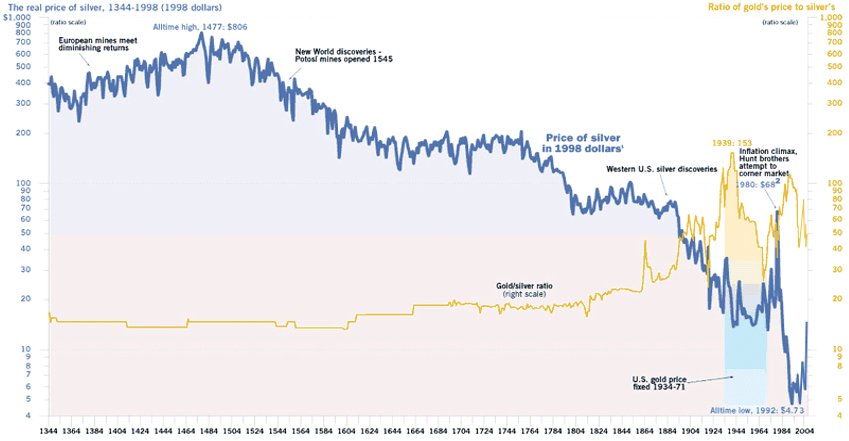

The media covered this move, of course. Forbes Magazine did a focus piece on the silver market, featuring a chart of the inflation-adjusted price of silver along the years. Below, you can see the chart for yourself. What this chart reveals is that Buffet was buying silver at its lowest price in recorded history. With this, people began to wake up to the undervalued safe haven.

While the data only covers until the year 1998, if this analysis were continued to include the last two decades, you would see that silver, on an inflation-adjusted basis, has already reached the $1,000 an ounce mark. Moreover, if this chart was replicated today, you would see that silver is now nearly as cheap as it was when Buffet bought it. (Remember: Chart is inflation adjusted).

Timing is everything, especially in a fast-moving market like the silver market, where 90% of the move comes in the last 10% of the time. An ounce of silver remains an ounce of silver, the only thing that changes is the price attached to it, and its value as a consequence.

Years of studying the precious metals has fortified the fact that silver and gold preserve wealth in the long-term. Whereas you hold these metals for decades and they maintain the same purchasing power throughout, there are times where they will overshoot in value substantially. What is becoming clear is that we are currently approaching one of those times, as a currency crisis begins to unfold.

Everything is now lining up for the asymmetric gains to materialize. Silver, particularly more than gold, will likely see these gains for a number of reasons. As an asset with a value that has been so misrepresented over the years, as an affordable asset, and as silver awareness and education continues to rise. The thing about silver and gold is that you don’t need a brokerage account, you don’t need a counterparty; in big cities there are dealers available in your immediate radius where you can trade your fiat for real wealth. If you are more rural, there is the Internet.

It’s important to stress the long-term when investing in these assets, however. Obtaining silver this week and expecting it to be much higher next week is short-sighted. The best way to approach this market is with a long-term mindset; become a stacker. Purchase small amounts of silver continuously, and when it starts to accelerate, reevaluate your goals. Even if you buy silver at a new high, it will go higher once we break the current trading range— that’s just how markets work.

With the rise of digital currencies, it is worth noting something here: with only 21 million Bitcoin that can be mined, in total, comparing the supply of Bitcoin with the supply of silver is an interesting contrast. There are only 2 million 1,000-ounce bars of silver — the commercial bars upon which the silver market is determined — so there are 1/10th as many silver commercial bars as there are Bitcoin, yet they are only worth roughly half of what a Bitcoin is worth. Bitcoin is in the ether, an intangible asset, whereas silver is an integral component in many of the devices that fuel our modern lives. Think about that.

Let us end with a deep-dive into the industrial demand of silver. Two decades ago, 35% of the silver market was industrial demand, roughly one-third of the entire market. Today, industrial demand accounts for half of the silver market. Silver remains a crucial part of the devices that fuel the digital age, and in theory, there are some innovations that could completely wipe out the silver market. If the world were to switch over to solar power, even though solar panels only use an incremental amount of silver, the silver supply would be under real threat. With the world embracing the green energy paradigm, this isn’t a scenario that seems too far off.

These are just some of the concepts I covered in my recent interview with The Early Stage Investor. You can watch the full video here.

For more content like this, join our free newsletter – Go to TheMorganReport.com and sign up.