Logical 4 Month Market Forecast – Gold, Oil, Stocks & Bonds

By Chris Vermuelen, GoldandOilGuy.com

Everyone is looking for the holy grail of the financial market which will tell what will happen next in stocks, commodities, bonds etc… Knowing that the holy grail of trading does not exist I am going to step out on a limb and share my four month stock market forecast along with commodities and bonds.

It is vital that you understand this is a 2-4 month forecast only and as the market evolves my outlook will change as I follow price action as closely as possible.

Here are some key points you need to know:

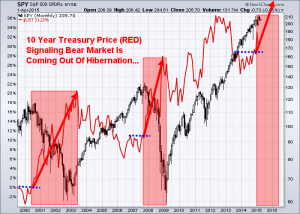

1. Bonds should perform well for a few months and possibly a long time until the bear market in US stocks takes hold and is well under way. BUT, the bond bubble will burst eventually when rates start to climb. This could be June, or much later in the year but until then I expect them to rise as the safe haven.

2. Commodities typically outperform equities during the late staged of the bull market which is what I feel the US stock market is. Resource stocks and resource rich countries like Canada should hold up well, and possibly make new highs going into summer.

3. Notice how gold and oil have moved from opposite corners of the chart compared to the US and Canadian stock indexes.

4. During the 2000 and 2008 bear market we saw gold, silver, oil and mining stocks get hit very hard in the second half of the bear market. Will this happen again? I do not think it will because this time rates are at zero and there is only one way to go when they are at the bottom… Up!. This means stocks and bonds will likely both enter a bear market, maybe not at the same time, but they will eventually. This means the only places to protect your capital will be commodities, resource based investments, or simply cash CAD & USD.

In short, safe havens for investor’s capital will be more of a dance during the next bear market in US equities.

With many countries devaluing their currencies and a potential bull market in commodities I expect the Canadian Loonie and US Green Back to hold the value if not rise over the next year or two.

If you want my long term investing signals my ETF swing trades so you can protect your capital and profit during the next bear market – Sign Up Today!

Chris Vermeulen

GoldandOilGuy.com

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.