In July I showed talked about the Russell 2K index and how it was underperforming the broad market. I went on to explain what it likely meant was in store for the US stock market this fall. The outlook was negative, just in case you were wondering…

This week I want to talk about two different sectors that have often lead the broad market in rallies and corrections over the years. These sectors have underperformed the broad market much like that of small cap stocks, and this does not bode well for investors going into fall.

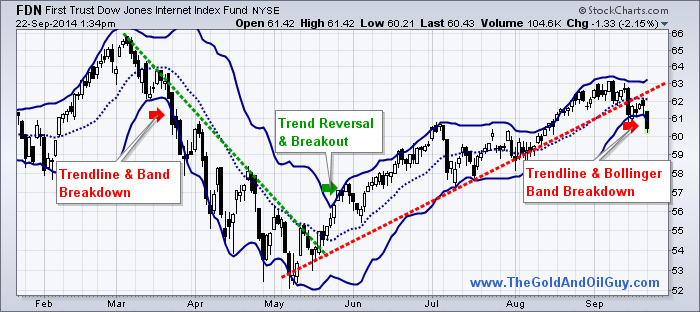

In the analysis below I use Bollinger bands and trendlines. Using only these tools keeps the charts clean and easy to understand. In short, once a trenline has been broken that is the first early warning that a trend may be coming to an end. The second is the break of a Bollinger band.

A combination of these can be taken as a trend reversal and likely the start of a multi week or month correction. This will depend on the chart time frame you are reviewing though. I use a similar method to identify trends with my automated futures trading system.

Because we have seen the support trend lines broken to the downside this month, and the fact that price has pushed more than 2 standard deviations from its norm, the odds favor more downside is to come.

From years of experience trading price patterns and breakouts I know that when price breaks to the downs side and triggers fear among its investors it is typically your best time to sell short so you can profit from the falling prices. Fear is the most powerful force in the stock market and it must be traded much differently than when prices are rising.

Although I feel the broad market is still within its uptrend, these two underperforming sectors may just continue to sell lower. Obviously once the broad market rolls over, these sectors should fall even faster to the downside but until then, they could chop around and grind their way down.

Like My Simple Analysis & Tips? Join My Free Newsletter at www.GoldAndOilGuy.com

Want My Trades Automatically Trade for You? www.AlgoTrades.net

Chris Vermeulen

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.